Corporate Transparency Act For Businesses

As of January 1, 2024, most small businesses in the U.S. must file a Beneficial Ownership Information (“BOI”) Report with the Financial Crimes Enforcement Network (FinCEN). This requirement is part of the Corporate Transparency Act (“CTA”), enacted in 2021 to combat illicit activities like tax fraud, money laundering, and terrorist financing, which exploit the anonymity of certain business entities. Pursuant to the CTA, those entities that operate in the United States and are designated as a Reporting Company in accordance with FinCEN’s guidelines must file a Beneficial Ownership Report in a timely manner to avoid civil and potential criminal charges as our East Greenwich, RI family private office lawyer can explain.

Here, we will outline which entities are considered Reporting Companies or exempt entities, the information contained in the BOI Report that you will have to turn over to FinCEN, deadlines for filing, and compliance and penalties for failure to comply.

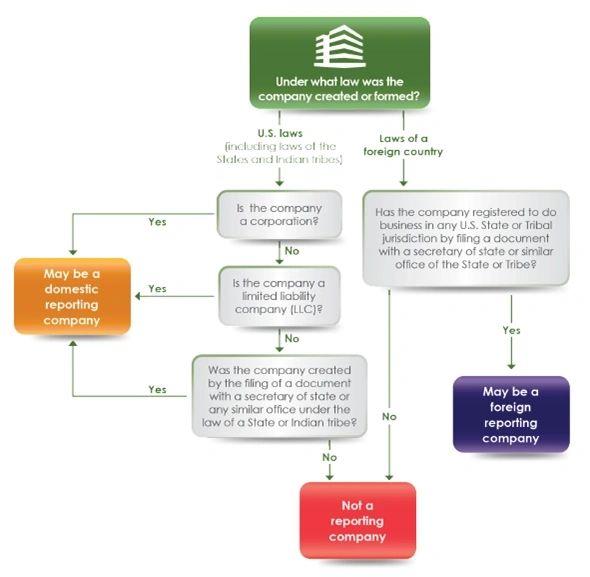

What Are Reporting Companies?

A “Reporting Company” under the CTA includes any corporation, LLC, or similar entity created or registered to do business in the United States through the filing of a document with a secretary of state or similar office, unless it qualifies for an exemption. This applied to both domestic entities as well as foreign entities that are similarly registered to do business in the United States. For further clarity, please see the enclosed chart below as provided in FinCEN’s BOI Small Entity Compliance Guide:

FinCEN’s BOI Small Entity Compliance Guide

Which Entities Are Exempt From These Reporting Requirements?

There are 23 types of entities exempt from the BOI reporting requirements primarily because they are typically subject to similar disclosure requirements by the nature of their industry, such as certain non-profit entities, entities in heavily regulated industries and large operating businesses.

- Securities Reporting Issuer: Entities that issue a class of securities registered under the Securities Exchange Act of 1934 or that are required to file periodic and supplemental reports under this Act.

- Governmental Authority: Entities established under U.S. federal, State, or a political subdivision of a state, or tribal laws, or under any interstate compact between two states that exercises governmental authority on behalf of the U.S. or any such Indian tribe, State, or political subdivision.

- Bank: Entities defined as a “bank” under the Federal Deposit Insurance Act, the Investment Company Act of 1940, or the Investment Advisors Act of 1940.

- Credit Union: Entities defined as “Federal credit unions” or “State credit unions” under the Federal Credit Union Act.

- Depository Institution Holding Company: Entities defined as “bank holding company” or “savings and loan holding company” under the Bank Holding Company Act or the Home Owners’ Loan Act, respectively.

- Money Services Business: Entities registered with FinCEN as money transmitting businesses or money services businesses.

- Broker Or Dealer In Securities: Entities registered as brokers or dealers in securities under section 15 of the Securities Exchange Act of 1934.

- Securities Exchange Or Clearing Agency: Entities registered as exchanges or clearing agencies under section 6 or 17A of the Securities Exchange Act of 1934.

- Other Exchange Act Registered Entity: Entities registered with the SEC under the Securities Exchange Act but not classified as a securities reporting issuer, broker or dealer in securities, or securities exchange or clearing agency.

- Investment Company Or Investment Advisor: Entities defined as and registered with the SEC as investment companies or advisers under the Investment Company Act of 1940 or the Investment Advisers Act of 1940.

- Venture Capital Fund Adviser: Entities identified as investment advisors as described in section 203(l) of the Investment Advisors Act of 1940 and that have filed Item 10, Schedule A, and Schedule B of Part 1A of Form ADV, or any successor thereto, with the SEC.

- Insurance Company: Entities defined as insurance companies under the Investment Company Act of 1940.

- State-Licensed Insurance Producer: Entities authorized as insurance producers by a State and subject to supervision by the insurance commissioner or a similar official entity and operating from a physical office in the U.S.

- Commodity Exchange Act Registered Entity: Entities that are registered entities as defined by the Commodity Exchange Act or registered as a “Futures Commission Merchant,” “Introducing Broker,” “Major Swap Participant,” “Commodity Pool Operator,” “Commodity trading Advisor,” “Retail Foreign Exchange Dealer” with the Commodity Futures Trading Commission under the Commodity Exchange Act.

- Accounting Firm: Public accounting firms registered in accordance with the Sarbanes-Oxley Act of 2002.

- Public Utility: Entities defined as regulated public utilities or providing telecommunications, electrical, natural gas, water, or sewer services within the U.S.

- Financial Market Utility: Entities designated as financial market utilities by the Financial Stability Oversight Council under the Payment, Clearing, and Settlement Supervision Act of 2010.

- Pooled Investment Vehicle: Investment companies as defined by the Investment Company Act that are identified by their legal name in its Form ADV filed with the SEC, or entities operating as pooled investment vehicles advised or operated by exempt entities, such as banks, credit unions, broker or dealer in securities, etc.

- Tax-Exempt Entity: Entities classified as tax-exempt under the Internal Revenue Code, including certain trusts and political organizations

- Entity Assisting A Tax-Exempt Entity: Entities operating exclusively to provide financial assistance of governance over tax-exempt entities and controlled exclusively by U.S. citizens or residents and that derive a majority of its funding or revenue from U.S. persons.

- Large Operating Company: Entities with over 20 full-time U.S. employees, more than $5 million in gross receipts or sales from sources inside the U.S., and a physical office in the U.S

- Subsidiary Of Certain Exempt Entities: Entities controlled or wholly owned, directly or indirectly, by one or more exempt entities.

- Inactive Entity: Entities in existence before January 1, 2020, not engaged in active business, not owned by foreign persons, and meeting other specific criteria.

For those with family-based businesses, keep in mind that legal expertise in instances like these can actually strengthen family relationships and avoid disputes later down the line.

Deadlines For Filing Boi Reports

- Companies Formed Before January 1, 2024: Must file by January 1, 2025.

- Companies Formed Between January 1, 2024, And January 1, 2025: Have 90 days from their effective registration date to file.

- Companies Formed After January 1, 2025: Must file within 30 days of their effective registration date.

Information Required In The Boi Report

Companies filing their initial BOI Reports will be required to provide the following information:

1. Company Information:

- Full legal name, trade names/ dbas (whether or not registered in the state in which you operate), principal business address, jurisdiction of formation, Taxpayer Identification Number (TIN), such as an SSN or EIN.

2. Beneficial Owners And Company Applicants:

- Beneficial Owners: Individuals who own or control at least 25% of a company or directly or indirectly exercise substantial control over it (e.g., senior officers or key decision-makers). For further information on this see Section entitled “Beneficial Owners” below.

- Company Applicants: Individuals who filed the documents with a secretary of state or similar entity that created or registered the company. Importantly, a company applicant is always an individual and cannot be a company and each company must have at least one company applicant and at most two. The first company applicant is the individual that directly filed the documents that created a company. This individual would have physically or electronically filed the document with the secretary of state or similar office. The second company applicant is optional and would be the individual who was primarily responsible for directing or controlling the filing of the creation or first registration document, but not for physically filing the documentation. Please note that companies formed prior to January 1, 2024, are not required to disclose company applicants.

3. Details To Provide For Each Beneficial Owner And Company Applicant:

- Full legal name, date of birth, residential or business address, unique identifying number (e.g., passport or driver’s license), and an image of the identification document.

Who Is A Beneficial Owner?

A Beneficial Owner is an individual who has substantial control over a company, either directly or indirectly, or owns at least 25% of its ownership interests. Each case requires careful evaluation to determine who qualifies as a beneficial owner.

Substantial Control: An individual has substantial control if they:

- Are a senior officer (e.g., CEO, CFO, General Counsel).

- Have the authority to appoint or remove key officers or directors.

- Make important decisions for the company (e.g., major contracts, asset transfers, mergers).

- Exercise any other form of substantial influence over the company.

Substantial control can be exerted directly through direct involvement or indirectly through relationships or arrangements with other entities or individuals. For example, direct control can be exercised by board representation (but not necessarily by all board members), ownership or control of a majority of voting power or rights, rights associated with financing and interests, or joint ownership with others of an undivided interest in the company. Conversely, indirect control can be exercised by controlling one or more intermediary entities that, individually or together, have substantial control over the company, or establishing financial or business relationships where other individuals or entities act as nominees, intermediaries, custodians, or agents on their behalf. Both forms of control constitute beneficial ownership pursuant to the CTA.

Ownership Interest: Ownership interests include equity, stock, voting rights, capital or profit interests, convertible instruments, or other mechanisms that establish ownership. If a company has issued options or convertible instruments, they are considered as exercised or converted for calculating ownership interest. For stock-issuing companies, ownership interest is calculated as a percentage of total shares issued, considering the different voting powers of various stock classes.

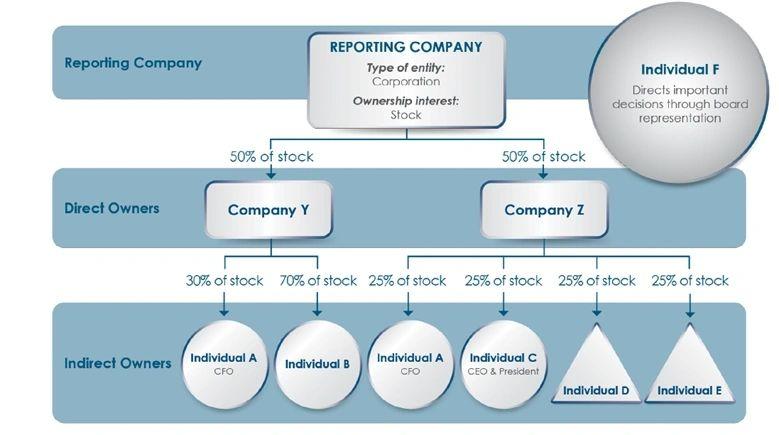

Determining beneficial ownership can be complex, especially in scenarios involving various ownership types, indirect control, or multiple entities. FinCEN’s Small Entity Compliance Guide provides the following scenario to illustrate how complex beneficial ownership identification can become:

FinCEN’s BOI Small Entity Compliance Guide

In this scenario:

- Individual A indirectly owns 27.5% of the reporting company’s stock through ownership in Company Y and Company Z and is a Beneficial Owner due to owning more than 25% of the reporting company.

- Individual B indirectly owns 35% of the reporting company’s stock through Company Y (50% of the reporting company × 70% of Company Y). Individual B does not exercise substantial control but is a Beneficial Owner due to owning more than 25% of the reporting company.

- Individual C as the Chief Executive Officer and President exercises substantial control, and indirectly owns 12.5% of the reporting company’s stock through Company Z (50% of the reporting company × 25% of Company Z), which is less than the 25% ownership threshold. Individual C is a Beneficial Owner due to exercising substantial control, despite not meeting the 25% ownership threshold.

- Individuals D and E each own 25% of Company Z, indirectly owning 12.5% of the reporting company (50% of the reporting company × 25% of Company Z). They do not exercise substantial control and are not Beneficial Owners due to owning less than 25% of the reporting company and lacking control.

- Individual F is a member of the board of directors and makes important decisions for the company, thereby exercising substantial control but does not own or control any stock in the reporting company. Individual F is Beneficial Owner due to exercising substantial control, despite not holding any ownership interests.

Exemptions From Reporting

If a beneficial owner is determined to be exempt, the company is not required to disclose him/her in its FinCEN Report. Individuals that are exempt as Beneficial Owners include Minors (with parent or guardian information provided instead), nominees or agents, employees (not senior officers), inheritors, and creditors (not otherwise beneficial owners). Importantly, exemptions may expire, for example upon a minor turning 18 or an individual inherits interest in a company they are no longer exempt, and a company will be required to file an updated BOI report listing them as Beneficial Owners.

Additionally, companies owned by an exempt entity do not need to report information about any beneficial owner whose ownership interests in a reporting company are held through one or more entities, all of which are themselves exempt from the reporting company definition. If this special rule applies, then you may report the names of all of the exempt entities instead of information about the individual who is a beneficial owner of your company through ownership interests in those exempt entities.

Finally, you do not need to report information about each beneficial owner and company applicant if your company was formed under the laws of a foreign country and would be a reporting company if not for the pooled investment vehicle exemption. If this special rule applies, you must report one individual who exercises substantial control over the company. You do not need to report any company applicants. If more than one individual exercise substantial control over the company, you must report information about the individual who has the greatest authority over the strategic management of the company

Compliance And Penalties

Failure to report complete or updated beneficial ownership information to FinCEN, or provide false information to FinCEN, may result in civil penalties, including up to $500.00 for each day the violation continues, or criminal penalties, including imprisonment up to two years and a fine up to $10,000.00. If you are a senior officer of a company that fails to file a BOI Report, you may personally be held responsible for that failure. If you in any way hinder a company’s efforts to file a BOI Report, such as by withholding necessary information, you will also be held personally responsible for that company’s failure to file a BOI Report.

Fortunately, if you inadvertently provide inaccurate information to FinCEN while filing your BOI Report, you have up to thirty (30) days to file an amended BOI Report to correct the error or omission.

Action Steps For Businesses

Businesses should prepare to comply with the CTA by gathering the necessary information and filing their BOI Reports by the applicable deadlines. Despite legal challenges, most entities should not delay in fulfilling these requirements to avoid penalties. At Aptt Law, we have extensive experience filing formation documents and ensuring that companies we represent are always compliant with State and Federal regulations. Not only can we file your BOI Report on your behalf, but we can also take reasonable measures to ensure your company’s ongoing compliance with the CTA, such as by amending governing documents to ensure accurate and up to date reporting of BOI Report information. We can also help you figure out how all this applies to your trusts set up through estate planning on behalf of your company.

If you need help with all this information, contact us at Aptt Law LLC so that we can put our decade of experience to work for you. Additionally, we have experience working with families that have over $300 million in assets, so we are ready to take on a case of any size.